Understanding Debt-to-Income Ratio for Homebuyers

Buying a home is a significant financial milestone for many individuals and families. It’s not just about finding the perfect property; it also involves a complex financial puzzle. One crucial piece of this puzzle is the debt-to-income ratio (DTI), a key metric that lenders use to assess a borrower’s ability to manage their mortgage payments. In this article, we’ll delve into the definition of the debt-to-income ratio and its importance for homebuyers.

What Is Debt-to-Income Ratio?

The debt-to-income ratio, often abbreviated as DTI, is a financial metric used to measure an individual’s or household’s financial health. It is calculated by comparing a person’s monthly debt payments to their monthly income. In the context of homebuying, lenders use DTI to determine if a potential borrower can afford to take on a mortgage.

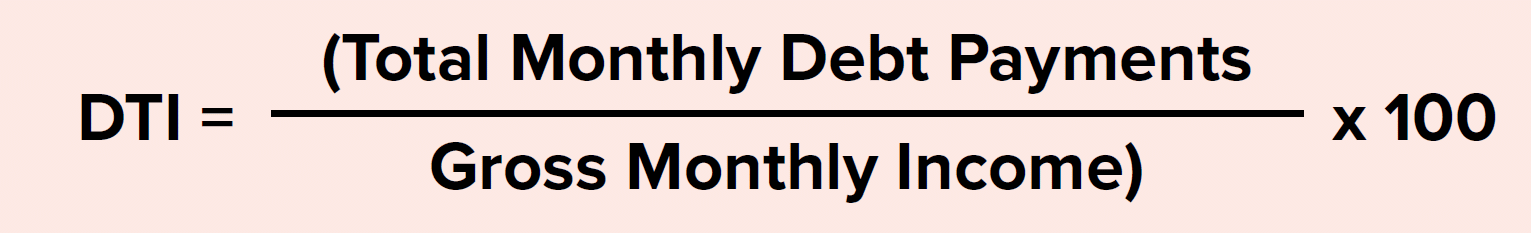

DTI is typically expressed as a percentage and is calculated using the following formula:

Total monthly debt payments include all recurring financial obligations, such as credit card payments, car loans, student loans, and other outstanding debts, in addition to the projected monthly mortgage payment for the property being considered. Gross monthly income includes all sources of income, such as salary, bonuses, commissions, rental income, and any other regular sources of earnings.

Find a Mortgage Lender

Start your search for mortgage lenders

© RGV New Homes Guide, 2023. Unauthorized use and/or duplication of this material without express and written permission from this site’s author and/or owner is strictly prohibited. Excerpts and links may be used, provided that full and clear credit is given to RGV New Homes Guide with appropriate and specific direction to the original content.