Ready to buy a home?

Owning a home can give you stability, security, and protection from rising housing costs.

Once you finish your mortgage payments, you’ll own a home that you can sell or pass along to loved ones after your death. Along the way, you may enjoy tax benefits.

But it’s a big responsibility. When you own a home, you pay for repairs, along with any property taxes, insurance, and Homeowner association dues that apply. If you want to move, you normally try to sell your home first before buying another one.

Save for a down payment

Most lenders won’t lend you the full price of a home. They want you to come up with some of the money yourself. That money is called a down payment.

Saving up for a down payment can be difficult. But a large downpayment can help you get a mortgage and reduce the interest rate you pay.

The amount of the downpayment depends on the type of loan. Making a 20% downpayment increases your chances of getting approved for a loan. But you might qualify for a loan program that requires only a low down payment, or no downpayment at all.

For example, imagine you want to buy a home worth $200,000:

• 20% down payment is $40,000

• 5% down payment is $10,000

• 3.5% down payment is $7,000

If you can’t afford a down payment of 20%, your lender may make you pay for mortgage

insurance. That increases your monthly costs.

Learn more at www.consumerfinance.gov

Source: Consumer Finance Protection Bureau

Check your credit

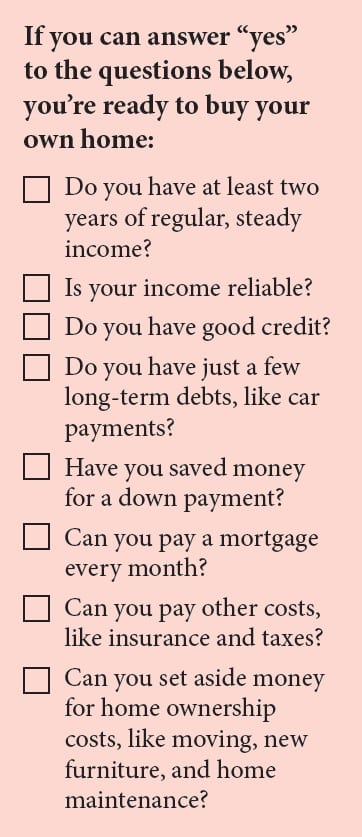

To get the best interest rate on a mortgage, you need good credit. For some loans, lenders want you to have a minimum credit score of 620, unless you have a large down payment.

You can get a free copy of your credit report, once every 12 months, from each of the three nationwide credit reporting companies. In addition, until the end of 2026, you can get six free credit reports every 12 months from Equifax.

Visit annualcreditreport.com, call (877) 322-8228, or download and complete the Annual Credit ReportRequest Form and mail it to the address on the form.

When you visit the site, you may see steps to view more frequently updated reports online.

Get ready to shop around for a home loan

Choosing the mortgage you’ll use to pay for your new home is an important decision. You can start by looking around for a network of people and information you trust to help you through the process. And, you can start gathering facts about your finances, so you’ll have them ready at your fingertips.

Tips for good credit

There are no secrets or shortcuts to building a strong credit score. Follow these tips:

- Pay your bills on time, every time

- Don’t even come close to “maxing out” your credit cards

- Be cautious about closing accounts that show a long history of on-time payments

- Apply only for credit that you need

More help is available

For resources, guidelines, and checklists that can help you, visit consumerfinance.gov/mortgage

New Homes Guide Magazine

The latest new home trends, up-and-coming neighborhoods, and more.

© RGV New Homes Guide, 2022. Unauthorized use and/or duplication of this material without express and written permission from this site’s author and/or owner is strictly prohibited. Excerpts and links may be used, provided that full and clear credit is given to RGV New Homes Guide with appropriate and specific direction to the original content.